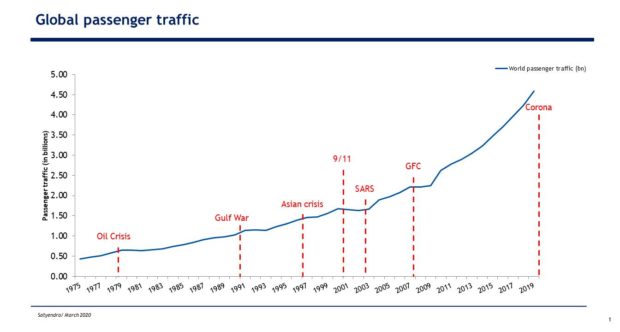

As the coronavirus continues to spread it is wreaking havoc on the airline industry. With 95,484 confirmed cases and 3,286 deaths, a vaccine and cure are yet to be found. Each day new cases are reported and air travel continues to be impacted. Forecasts from various industry quarters including IATA estimate a drastic decline in demand. Losses emanating from this decline were initially estimated to be around USD 30 billion and have since been revised to figures that are north of USD 100 billion. Needless to say, the outlook is extremely pessimistic.

Demand has fallen drastically

To give an idea of the demand fallout a comparison helps.

- 1991 Gulf War: 7% – 9% reduction in passenger demand

- 2001: 9/11 & US Recession: 12% reduction in some markets and a host of airline bankruptcies

- 2003: SARS: 20 % decline in demand in Hong Kong (and peak demand declined up to 50%)

- 2004: Indian ocean earthquake/tsunami: up to 35% reduction in demand for Bali & surroundings

- 2010: Eyjafjallajokull – volcanic eruption: 20-30% reduction in demand

- 2020: Corona Virus – demand decline estimated to be up to 40%

What is even more challenging is that the spread of the virus is global and Asia and Asia Pacific are most impacted. This region is also a growth engine for passenger traffic and the countries of China (including Hong Kong), Japan, Singapore, South Korea, Thailand, Indonesia and Malaysia together account for ~30% – 32% of global passenger traffic. They are also key destinations for low-cost and full-service carriers alike.

On a macro-level, several forecasts indicate the likelihood of a recession and the associated impact on air-travel is all but certain.

Capacity adjustments to severely impact cash-flow

Airlines have been making drastic capacity adjustments to react to the situation. Adjustments of this sort across global aviation have never before witnessed. Cathay Pacific has grounded 60% of its fleet, Lufthansa has grounded 6% of its fleet, United Airlines is slashing its international capacity by 20%. The list goes on…

This has consequential impacts on cash-flow. Because airlines are fairly unique in the sense that they collect money for tickets upfront and service is rendered at a later date. That is, an airline sells for cash-flow and flies for profit and loss. With demand severely depressed forward bookings for several routes (the large portion in the Asia Pacific) have collapsed. Thus, airlines are forced to look at interim measures to generate cash, rely on their balance-sheet strength or ensure that the cash-flow impact is mitigated via other interventions.

The International Air Transport Association initially forecast that airlines will collectively lose USD 27.8 billion of revenue in 2020. This was then updated to 112 billion (on March 5th). Within a week the loss forecast quadrupled. This figure may be updated further. Much of these losses will be driven by a demand/supply mismatch and thus the rush to adjust capacity. But capacity adjustments come at a cost. For airlines to reduce utilization or in extreme cases, ground aircraft effectively means that they are idling assets that otherwise would generate cash. All this while lease payments, airport charges and employee costs continue to accrue.

To alleviate the situation, Cathay Pacific and Emirates have already asked staff to take voluntary leave; airlines in the US are flying 787s which would have flown international routes in the domestic market; Lufthansa and British Airways are reviewing fleet inductions and de-inductions and most recently Air Asia has announced a $118 all you can fly for a year scheme. Similar efforts and schemes by other airlines are likely to follow.

No certainty on when demand may pick-up again

“We are bad at forecasting … not because we can’t analyze how an event will impact the economy. We just can’t analyze events we haven’t considered to begin with. Risk is what you don’t see” – Morgan Housel

The coronavirus is effectively a black-swan event. And airlines the world over are no strangers to such events. Indeed airlines have witnessed shocks ranging from oil crises of 1979 to the spread of the Severe Acute Respiratory Syndrome in 2003. But what makes the Coronavirus especially challenging is the scale and spread of the virus. A situation like this has simply not been seen before. What originated in one country has now spread to sixty countries and counting.

After each crisis passenger demand has shown varied patterns in returning to pre-crisis levels. But this time airlines also have to cope with the viral spread of information (as well as misinformation and disinformation) via social media coupled with a global economic slowdown. Further, once the virus is contained and consumers feel more confident about booking travel, airlines are likely to engage in intense discounting. This will be driven by the cash requirements (especially for those with weak balance sheet). And if one airline does it others will have to match. A downward spiral is likely to ensue. And overall the industry is likely to lose money in 2020.

A turbulent return to the skies awaits.

Bangalore Aviation News, Reviews, Analysis and opinions of Indian Aviation

Bangalore Aviation News, Reviews, Analysis and opinions of Indian Aviation

2 comments

Pingback: How airlines are responding to the Corona virus threat – Bangalore Aviation

Pingback: Ministry gives airlines a pass to refuse passengers refunds – Bangalore Aviation